Ben Barrison and Rahul Varma consider the impact of company voluntary arrangements on landlords and the steps they can take to protect themselves

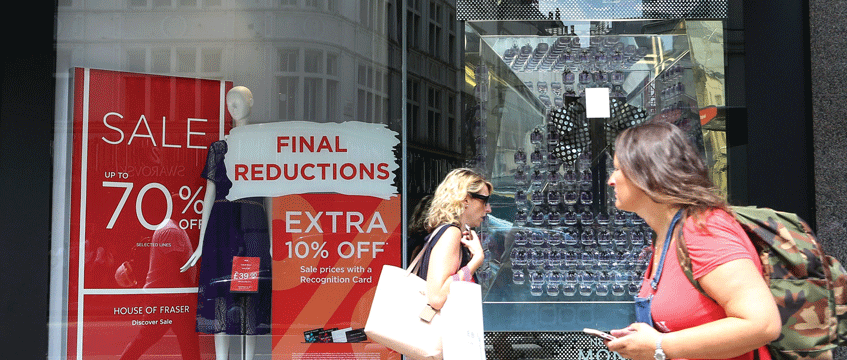

The list of retailers who have sought company voluntary arrangements (CVAs) in 2018 makes for startling reading. House of Fraser can be added to Prezzo, Jamie’s Italian, New Look, Carpetright, Mothercare and Byron in seeking to use the process. This depressing run was foreshadowed by the “Christmas CVA” entered into by Toys R Us – only for Geoffrey the Giraffe et al to succumb to administration a few months later.

Landlords’ objections

Landlords have long been ambivalent about CVAs. That ambivalence is turning into outright hostility.

On 7 June 2018, the British Property Federation (BPF) issued a press release stating that the process “is now being misused”, and calling for the government to launch an urgent review. The BPF notes the “increasing frustration” of landlords who are too often seeing their contractual relationships subverted by CVAs that have been imposed in an opaque and unfair way.

Earlier this year, a suite of reforms to the CVA process was recommended by the influential R3 Association of Business Recovery Professionals.

The problem for landlords is that a CVA is the only insolvency process that (a) permits the existing management of the company to stay in their roles, and (b) allows for the unilateral variation of lease terms while the company otherwise retains the full benefit of the demise.

Some argue that recent use of the process flies in the face of the Landlord and Tenant Act 1954 (the 1954 Act) and/or section 2 of the Law of Property (Miscellaneous Provisions) Act 1989, which afford protection to parties dealing with business leases and real estate contracts.

Of course, every CVA is different and it is likely that successful cases are under-reported relative to the controversial ones. However, given the potential pitfalls, there are several issues that any landlord faced with a CVA should be alive to.

Agreeing the CVA

A CVA requires the support of at least a 75% majority of the company’s unsecured creditors. If obtained, this majority then binds the other 25% even if the proposal is prejudicial to their interests. The deemed value of a landlord’s debt determines the size of its vote. Accordingly, a landlord’s ability to maximise the value of its debt will determine its direct influence on the terms.

The creditors’ meeting is key. Unless a debt is ascertained and liquidated, the chair need only value the landlord’s debt at £1, save where otherwise agreed. One would ordinarily expect any arrears of rent to be ascertained and liquidated, but other common claims are more problematic. In respect of future rent for the remainder of the contractual term, an issue arises as to whether any provision for early determination of the lease causes uncertainty as to the timing and terms of the landlord’s re-letting. In respect of dilapidations, the value of the claim is unlikely to have crystallised by the date of the creditors’ meeting.

A landlord facing a CVA should thus endeavour to make as much cogent evidence available to the chair as possible. The likely impact of any rent review, break clause or forfeiture provisions should be addressed with reference to expert evidence. The landlord will have little time to act, though; the creditors’ meeting can be called at 14 days’ notice.

Challenging the CVA

CVAs are difficult to challenge because the proposal will be judged against the alternatives for creditors – ie administration or liquidation. However, the Insolvency Act 1986 does provide two grounds on which a creditor entitled to vote at the meeting can seek suspension or revocation of the proposal within 28 days of the chair’s report of the meeting being filed at court.

The first ground is where the CVA “unfairly prejudices” a creditor or creditors. Where (as is often the case) real estate liabilities are the focus of a CVA, landlords should consider working together if they are likely to have received more under an alternative insolvency process. In particular, where a CVA aims to reduce real estate liabilities but leave the interest of trade creditors untouched, could it be argued that the proposal is “unfairly prejudicial” to landlords as a class of creditor?

The second ground is where there has been some “material irregularity” at or in relation to the creditors’ meeting. The question is whether the conduct complained of, objectively viewed, would have made a material difference to the creditors’ assessment of the CVA.

A clear example would be where a landlord was not properly notified of a meeting but, had the landlord attended and voted, the outcome would have been different.

Another angle might be to challenge arbitrary assessments undertaken by the nominee that are not based on proper valuation advice. There is a substantial body of case law on how landlords’ claims should be valued in a voluntary liquidation – can the nominee justify apparently arbitrary reductions to those numbers for the CVA?

Landlord and Tenant Act 1954

While a CVA can settle contractual relationships, far less clear is how it interacts with other statutes – in particular, the 1954 Act. For example:

(a) Can an agreement to surrender under the CVA be effective if the “contracting out” procedure under the 1954 Act has not been complied with first? Will an agreement to serve such papers pursuant to the CVA suffice?

(b) If the CVA agrees a reduction in rent but is silent as to successor leases, will a tenancy granted pursuant to a statutory renewal be subject to the CVA?

Neither of these issues has been tested at court. However, there is employment case law about anti-avoidance provisions to suggest that the CVA might be able to side-step the strict contracting-out requirements of the 1954 Act. The provisions of many CVAs seem at odds with best practice for contracting out but are likely to create an “acceptable” fudge, by which the lease ends with a clean enough slate for the landlord to re-let.

For renewals, CVAs will not prevent a landlord from serving a section 25 notice, so no doubt the tenant must apply to court for a new lease to ensure its interest is protected. Once that step is taken, our view is that the court must still have jurisdiction to determine the terms of the new lease under the usual 1954 Act principles. It would then be for the parties to agree or the court to determine where the renewal lease will sit in relation to the CVA process – assuming that it is still engaged by the time the renewal lease completes.

Forfeiture

A landlord’s right to forfeit is unaffected by the CVA, save where the CVA itself provides otherwise and/or the tenant is a “small company” invoking the statutory 28-day moratorium. In any event, the landlord will not be able to forfeit in relation to arrears or other breaches that have been settled by the CVA – even if proceedings had been issued in respect of the same prior to the CVA taking effect.

If there is no moratorium, then the landlord may rely on a forfeiture provision triggered by “any step taken in connection with” – not just “entry into” – the proposed CVA. If properly drafted, such provisions can at least give the landlord the option to forfeit where, for example, re-letting would be preferable to accepting a reduction in rent.

Securities

CVAs do not usually affect the liability of a tenant’s guarantor, although this is permissible in principle, so the terms of the CVA and guarantee alike should always be checked.

Rent deposits are generally more susceptible to CVAs. This is because the deposit may concern a claim compromised under the proposal. However, as CVAs do not affect secured creditors, one solution might be to make the landlord a secured creditor by treating the rent deposit as a charge in the landlord’s favour.

The technicalities of such a solution would merit careful analysis on a case-by-case basis – not least because as such a charge would no longer need to be registered at Companies House. Even if the technical hurdles can be overcome, a landlord would have to assess the commercial risks of insisting on security in a market where such a requirement is far from common.

Change needed?

The CVA seems set to be the troubled tenant’s rescue procedure of choice for the foreseeable future. The current legislative framework allows a company to deal with its liabilities in a dynamic fashion without formal insolvency. That option is appealing to companies facing challenging trading conditions. However, is it fair? Or even sustainable?

Perhaps it is time for legislators to heed the ever-louder calls for reform.

Pic credit: Dinendra Haria/REX/Shutterstock

Ben Barrison is a partner in property litigation at Forsters and Rahul Varma is a barrister at Selborne Chambers